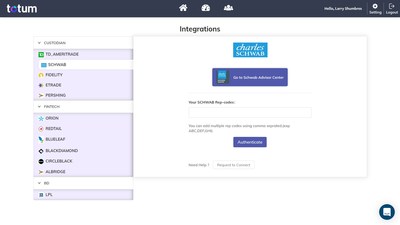

Following Schwab’s annual IMPACT® conference, Totum Risk™, an investment risk tolerance tool that calculates risk capacity in addition to risk preference, announced single sign-on integration with Schwab Advisor Center platform; becoming one of the first WealthTech providers to offer this capability.

Totum Risk’s life events questionnaire offers technology that calculates an investor’s risk capacity, or how much risk an investor can take given their current life situation, and compares it to their risk preference, or how much risk an investor is willing to take. The resulting risk scores help advisors create a portfolio unique to each client’s risk capacity. Additionally, Totum Risk’s questionnaire is easy to take, improves compliance, holds up in arbitration, and offers an enhanced client experience including custom analytics, model marketplace, portfolio comparison reports, and custom proposals, now with seamless access to the Schwab Advisor Center platform.

“We’re pleased to welcome Totum Risk in to our growing list of integration participants,” says John Connor VP of Digital Advisor Solutions at Charles Schwab. “Their approach to risk analysis is a valuable compliment to the platform and aligns well with our goal to enhance the advisor experience through integrations with best-in-class providers.”

“Working in the financial industry for 20 years, I know how important it is to have the right tools available for registered investment advisors. It has to be easy to use, accurate and helpful, and most important, add value to the advisor/investor relationship. I developed Totum Risk with these key points in mind,” says Larry Shumbres, CEO Totum Risk. “The streamlined integration between Totum Risk and Schwab Advisor Center offers advisors a risk tolerance tool that stands out from every other risk assessment product on the market by not only looking at an investor’s current life situation, but also providing the tools for the advisor to follow up annually, adding a much needed personal touch-point, exceptional customer service, and groundbreaking accuracy. I am confident that advisors will immediately see the benefit of using our product compared to traditional risk tolerance tools.”

The addition of Totum Risk’s single sign on integration with the Schwab Advisor Center platform makes it even easier for advisors to work between the two applications. For a demo of how Totum Risk’s questionnaire can benefit your business, visit www.totumrisk.com or email contact@totumrisk.com.

About Totum Risk

Totum Risk provides a defensible multi-scoring risk tolerance toolkit that enables financial advisors, insurance agents, and plan sponsors to create a more accurate investment strategy. Financial services organizations of all sizes utilize Totum’s proprietary risk scoring models to calculate portfolio risk based on an investor’s current life situation and not just their risk preferences. Founded in 2015, Totum Risk is headquartered in Atlanta, Georgia with offices in Los Angeles, California. For more information, visit www.totumrisk.com.