Finance

PrimeRevenue Accelerates $53 Billion in Global Early Payments During First Half of 2020

Lucena Research Partners With Benzinga Over Newsfeed Sentiment Analysis

Equifax Helps Organizations of All Sizes Respond to Impact Of COVID-19 on Their Business

Financial Planning App The Beans Launches in Atlanta

The Beans, founded by a former math teacher with a vision to eliminate financial stress for teachers and other early-career millennials, today launches its financial planning iOS app. As part of the launch, The Beans has rolled out financial wellness workshops to more than 30 schools and organizations in the Atlanta Metro Area.

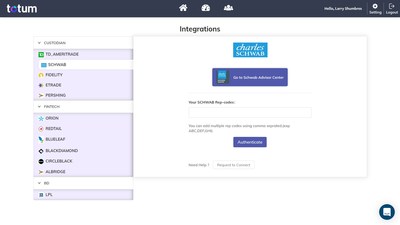

Totum Risk® Announces Integration with Schwab Advisor Center®

Following Schwab's annual IMPACT® conference, Totum Risk(TM), an investment risk tolerance tool that calculates risk capacity in addition to risk preference, announced single sign-on integration with Schwab Advisor Center platform; becoming one of the first WealthTech providers to offer this capability.

Bank Shot App Grows Competitive Advantage Through White Label Customization

Bank Shot, an app built for speed and security in sending earnest money is now emerging as the premier payment solution for not only earnest money, but much more. Bank Shot provides an easy solution for paying commissions, collecting rent, Home Owner's Association (HOA) dues, post-closing payments, and other fees. From the field to the office, each transaction is done quickly and securely. And now, an upgraded White Label version of Bank Shot is the preferred option for an ever-growing list of companies, due to the ability to customize the app and maximize its usage within their existing platform.

Jamestown Launches Direct-to-Consumer Investment Platform: Jamestown Invest

Jamestown, a leading real estate investment and management firm, today announced the launch of its new online direct-to-consumer investment platform Jamestown Invest. Investing and managing real estate on behalf of nearly 80,000 entities to date, the company's latest initiative will provide U.S.-based investors the opportunity to directly invest in Jamestown real estate for the first time across a variety of national markets. This $50 million fund will acquire diverse properties with a focus on mixed or single use assets incorporating office, retail, multifamily, for-sale residential parking, unimproved land, warehouse/flex, and hotels, including properties with potential for repositioning or redevelopment. Jamestown will build on its expertise of repositioning historic assets into iconic mixed-use destinations, such as Chelsea Market in New York and Ponce City Market in Atlanta. Utilizing Jamestown's vertically integrated business model, this platform seeks to democratize access to real estate investment opportunities, allowing consumers to invest with a minimum of $2,500.

Flagship Bank Verification IBV Now Faster, Smarter, and More User-Friendly Than Ever

MicroBilt today announced the release of the latest version of IBV - Instant Bank Verification - it's market-leading financial data aggregation and verification solution that enables lenders to instantly qualify potential borrowers.

Equifax Announces New Senior Leader For Global Consumer Business

Equifax Inc. (NYSE: EFX) has named Beverly Anderson president of Global Consumer Services (GCS), replacing Dann Adams who has announced his retirement.

Revegy Reimagines Collaboration and Whitespace Mapping

Revegy, the enterprise account planning platform for revenue optimization, rolled out two new features in its Fall Release: Whitespace(+) and Contacts(+).