PrimeRevenue, Inc., the leading provider of technology-enabled B2B payments and working capital solutions, has developed an enhancement to its receivables platform that allows banking partners to expand their receivables programs. The feature is the first of its kind available on the market.

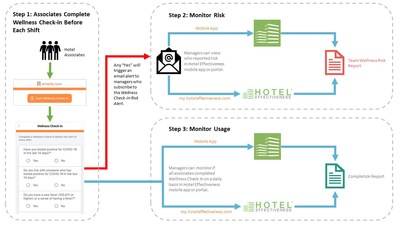

The new feature solves widespread industry challenges and removes barriers to participation in selective receivables finance, including:

- Human error leading to compliance risk in monitoring of payment terms, due dates, and other critical invoice tracking requirements

- Fluctuating payment terms (such as government contracts, etc.) pushing some obligors out of scope

- Reconciliation processes which are cumbersome and time-consuming for sellers or funders

With the feature, sellers upload a single open item file, and the system automatically handles all reconciliation and new transaction activities. This capability, coupled with the flexible reporting in PrimeRevenue’s receivables platform, provides 100 percent transparency into the invoice lifecycle from time of transfer under the receivables purchase facility to payment by the obligor.

Not only does this functionality support invoice tracking requirements for compliance, but it also streamlines processing for banks and their customers while expanding the scope of invoices that are eligible for selective receivables finance.

“Historically, it has been nearly impossible for companies that don’t have certainty around invoice payment terms to be included in selective receivables finance,” said Dominic Capolongo, EVP Global Head of Funding of PrimeRevenue. “This is due to onerous administrative processes required for banks to determine the tenor and associated fees. To solve this challenge, we developed a solution that enhances the transparency of invoices, which reduces operational hassle for both banks funding selective receivables finance programs as well as their clients.”

PrimeRevenue has already seen success with this structure in pilots with existing partner banks and has plans to extend it to all current and future partner banks using the selective receivables product.

About PrimeRevenue

PrimeRevenue’s supply chain finance (approved payables financing) solutions help organizations in 80+ countries optimize their working capital to efficiently fund strategic initiatives, gain a competitive advantage and strengthen relationships throughout the supply chain. As the leading provider of working capital financial technology solutions, PrimeRevenue’s diverse multi-funder platform processes more than USD$250 billion in payment transactions per year. The company is headquartered in Atlanta, with offices in London, Prague, Hong Kong and Melbourne. Additional information about PrimeRevenue can be found at www.primerevenue.com | Twitter: @primerevenue | LinkedIn: www.linkedin.com/company/primerevenue.

Media Contact

Ariane Wolff

Warner Communications

+1. 978.729.3542 (U.S.)